Understanding Medicare Guide

The quick and easy guide to understanding the Medicare options available to you.

Medicare Defined

What is Medicare?

Medicare is a government sponsored program that provides medical coverage for people 65 and older. People who are under 65 may be eligible for Medicare if they have certain disabilities.

The next few pages will explore each part of Medicare and highlight the options available to you. When you get to the end of this guide, you will have a better understanding of Medicare and the available options, so you can make a more thoughtful decision on the best plan for your situation.

Terms You Should Know

Premium - the amount you pay each month for your health plan to Medicare, a private insurance company, or both, depending on your coverage.

Deductible - the amount that you pay out of pocket for covered services before your plan begins to pay.

Copayment (Copay) - the set fee you pay when you visit your doctor or fill a prescription. For example, you might pay $12 when you fill a prescription.

Coinsurance - the percentage of the cost you pay for a covered service. For example, you might pay 20% and your plan would pay 80%.

Out-of-Pocket Maximum - the total amount you might pay during a calendar year. After you reach your out-of-pocket maximum, your plan pays 100% of the allowed amount for covered services.

As you review your options, it’s easy to focus on premiums as they are a regular monthly expense. However, depending on your needs, a plan with a low monthly premium might end up costing you more based on the deductible, copays, or out-of-pocket maximum. It’s a smart idea to look at the full scope of the available plans.

Medicare has Four Parts

Part A - Hospital Insurance

Part B - Medical Insurance

Part C - Medicare Advantage Plans

Part D - Prescription Drug Converage

Medigap - Medicare Supplement Plans

The Parts of Medicare

Original Medicare

Medicare Part A + Medicare Part B

Medicare Part A works in conjunction with Medicare Part B. The two are often referred to as Original Medicare.

Medicare Part A: Hospital Insurance

What it Covers:

Hospital Stays

Home Health Care

Hospice Care

Skilled Nursing Facilities

Your Extra Costs:

Deductibles

Copays

Coinsurance

Medicare Part B: Medical Insurance

What it Covers:

Outpatient Procedures

Doctor Visits

Lab Testing

Ambulance Rides

Your Extra Costs:

Annual Deductibles

Monthly Premiums

Coinsurance

Original Medicare covers a lot of the health care you may need, but it doesn’t cover everything. If you only have Medicare Part A and Part B, you will pay the full costs for many services not covered by Original Medicare:

Prescription drugs you take at home

Dental care & most dental services

Routine eye exams & eyeglasses

Routine hearing exams & hearing aids

Routine physical exams

Transitional care in a skilled nursing facility without a qualifying 3-day hospital stay

Most care you receive when traveling outside the U.S.

Adding Private Plans to Improve Coverage

Your healthcare needs are personal.

When it comes to supplementing your Medicare plan with private insurance, you have two options: the first option is known as Supplemental Coverage. It is made up of several parts and you have the choice to add or omit additional coverage like Medigap or Part D. Your second option is Medicare Part C (Medicare Advantage Plans). This is essentially your one-stop-shop for Medicare coverage. Let’s continue to learn about each part of your two Medicare options.

Medicare Part C: Medicare Advantage Plans

What it Covers:

Medicare Part A & Part B Benefits

Most plans include Medicare Part D (prescription drug coverage)

Some plans also cover dental, vision, & hearing

Your Extra Costs:

Annual Deductibles

Monthly Premiums

Coinsurance

Copays

These plans often offer more coverage than Original Medicare at a lower cost. This is possible because these plans are made up of network providers.

Medicare Part D: Prescription Drug Insurance

What it Covers:

Prescription Drugs

Your Extra Costs:

Annual Deductibles

Copays

Coinsurance

Monthly Premiums

Medigap: Medicare Supplement Plans

What it Covers:

Helps fill the “gaps” in

Original Medicare

Can reduce out-of-pocket costs

Your Extra Costs:

Premiums

What Are My Options?

So which plan is right for you?

Take a few minutes to look over the following charts to get a better understanding of what your two Medicare options offer. While each individual plan differs, this is a good, general overview.

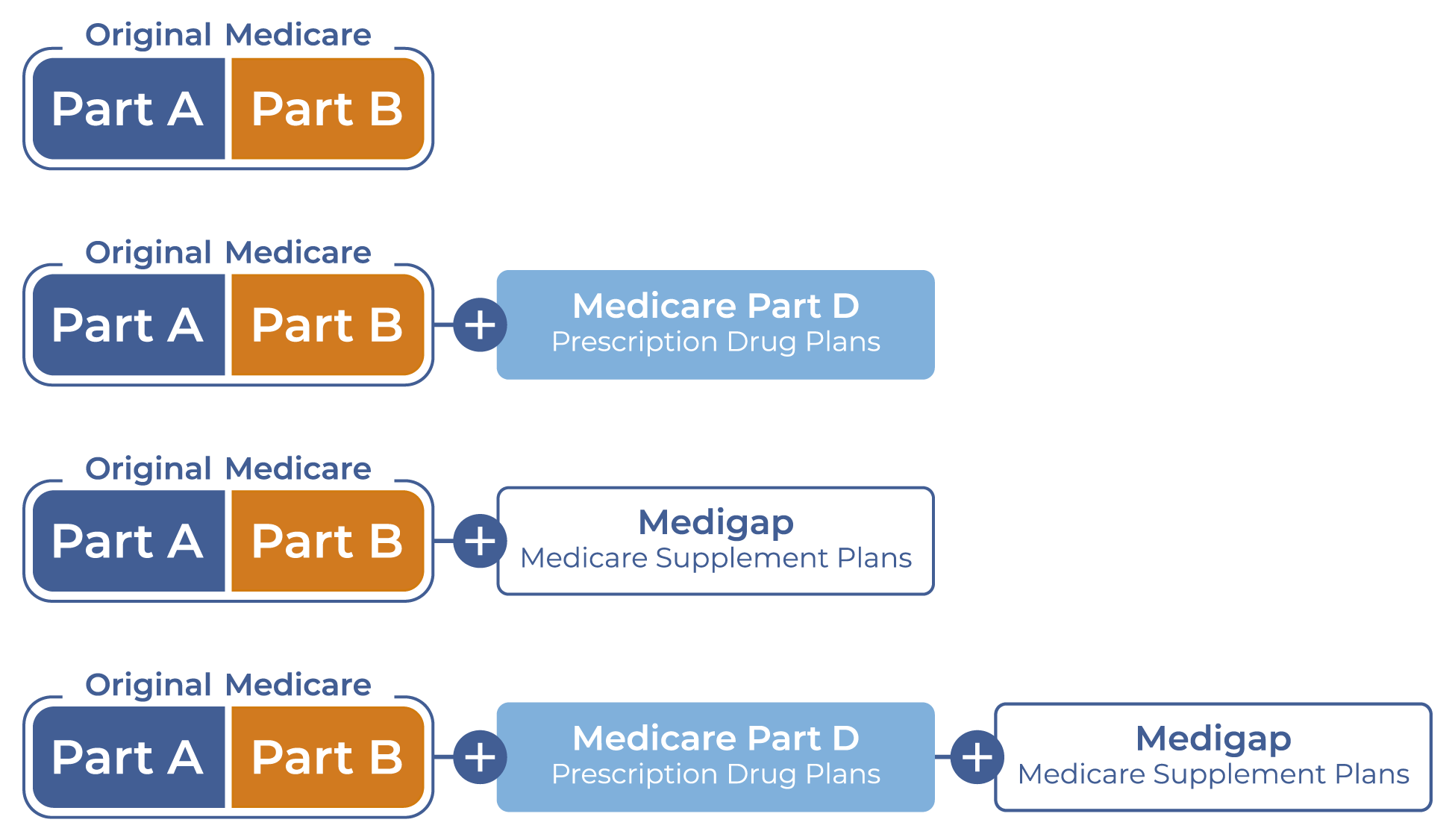

Option One: Original Medicare

You have the option to add Part D, Medigap, or both to Original Medicare.

Option Two: Medicare Advantage Plans

Your second option is to receive Medicare benefits through a Medicare Advantage plan (Part C). Most plans come with prescription drug coverage. You may have the option to add a stand-alone Part D plan to certain Medicare Advantage plan types.

Comparing Medicare Supplement & Medicare Advantage

Original Medicare + Medigap

Freedom to choose doctors and hospitals (as long as they accept Medicare patients.)

Medicare Advantage Plans

You may be limited to doctors and hospitals within your plan network.

Original Medicare + Medigap

No referral is needed to be seen by a specialist.

Medicare Advantage Plans

A referral may be needed to be seen by a specialist. You may be limited to specialists within your plan network.

Original Medicare + Medigap

There are no network restrictions.

Medicare Advantage Plans

There may be network restrictions. Domestic emergency care is covered and international visits may be covered.

Original Medicare + Medigap

Apply any time after you turn 65 and have joined Medicare Part B.

Medicare Advantage Plans

You may be limited to enrolling (or switching plans) during certain times of the year.

Original Medicare + Medigap

You pay your Part B premium and a monthly plan premium. Out-of-pocket costs are limited.

Medicare Advantage Plans

Generally, you pay a low monthly premium plus your Medicare premium. You may pay co-insurance, co-pays, and deductibles. Out-of-pocket costs are limited.

Original Medicare + Medigap

There is no prescription drug coverage. Purchase a Medicare Part D plan for prescription drug coverage.

Medicare Advantage Plans

Most plans offer prescription drug coverage.

Original Medicare + Medigap

Does not cover vision, hearing aids, or dental care.

Medicare Advantage Plans

Vision, hearing aids, and dental care, plus other healthy living extras, are included in some plans.

Med City Medicare makes it easy to get free, unbiased advice.

Schedule a consultation

Receive a free review

Get the best plan for you